At AMSA We Believe Health Care is a Human Right, Not a Luxury

Code Blue News Alert

January 9, 2026

U.S. House Votes to Renew ACA Tax Credit

Bill Now Moves to U.S. Senate

On Thursday this week the U.S. The House of Representatives passed a clean 3-year extension of the tax credits that make health insurance affordable for millions of Americans through the Affordable Care Act (ACA). 17 Republicans voted yes alongside all House Democrats to pass H.R.1834 – Breaking the Gridlock Act, the final vote count was 230 to 196.

The following House Republicans who voted to extend the tax credits and protect the constituents from skyrocketing health insurance premiums:

- AR-03 Rep. Robert Wittman (R)

- CA-22 Rep. David Valadao (R)

- CO-03 Rep. Jeff Hurd (R)

- FL-27 Rep. Maria Salazar (R)

- IA-03 Rep. Zachary Nunn (R)

- NJ-07 Rep. Thomas Kean (R)

- NY-01 Rep. Nick Lalota (R)

- NY-02 Rep. Andres Garbarino (R)

- NY-17 Rep. Michael Lawler (R)

- OH-07 Rep. Max Miller (Ohio) (R)

- OH-14 Rep. David Joyce (R)

- OH-15 Rep. Mike Carey (R)

- PA-01 Rep. Brian Fitzpatrick ®

- PA-06 Rep. Robert Bresnahan (R)

- PA-07 Rep. MacKenzie (R)

- TX-15 Rep. Monica De La Cruz (R)

- WI-03 Rep. Derrick Van Orden (R)

See the Roll Call Vote – Learn who YOUR U.S. House Rep is HERE

The fight to renew the ACA tax credits now moves to the U.S. Senate where its fate is dubious. Key Senate negotiators might be nearing a deal to extend the credits. A bill that would extend credits for 2 years, not 3 years as in the House bill, may be introduced next week. Maine Senator Susan Collins and Ohio Senator Moreno are championing a bill that would reinstate the ACA tax credits that expired at the end of 2025, but also include some new measures that would restrict eligibility for ACA by setting income caps (none exist right now–rather than specific income limits are based on percentage of income spent on healthcare). Expanding Health Savings Accounts is also under consideration; and Senators opposed to abortion care are pressing for further restrictions on abortion services to also be included. See resources below.

Your 2-minute call can help create a new year miracle for millions of American families!

Call both YOUR US Senators at 202-224-3121 (Call anytime 24/7)

Urge them to take quick action in the new year to renew the ACA tax credits

THEN SHARE INFO WITH FRIENDS, FAMILY & COLLEAGUES!

Find both YOUR U.S. Senators HERE & a sample customizable script below

Hello:

My name is [First Name] [Last Name]–. I live in [insert town, city]. I would like to leave a message for the Senator.

I’m studying to be a physician, and I’m very concerned about the looming expiration of the Affordable Care Act enhanced premium tax credits. Failure to renew these tax credits will make premiums unaffordable and cause millions of people to lose health coverage. Our country can do better.

As a future physician I also understand abortion care is basic, necessary health care. Limiting access to abortion care should NOT be a requirement for renewal of the ACA tax credits.

Health care is not a luxury. Congress must take quick action before year end to avoid cutting healthcare coverage, it’s a basic human need. I urge Senator/Representative [Name] to vote to renew the ACA premium tax credits.

Thank you for taking my call.

- Health Savings Accounts, Backed by GOP, Cover Fancy Saunas but Not Insurance Premiums, KFF Health News – Link

- Health Savings Accounts: Robin Hood in Reverse, Georgetown University Center on Health Insurance Reforms – Link

- Expanding Health Savings Accounts Would Do Little to Improve Access to Affordable Health Care, Center on Budget & Policy Priorities – Link

- Deeper Dive: Very Small Share of HSA Benefits Goes to People with Low Incomes – Link

Code Blue News Alert Archive

A 2-minute call can help create a new year miracle for millions!

Earlier this week, the House passed a health care bill that failed to address the impending expiry of Affordable Care Act enhanced premium tax credits. If the looming expiry of these tax credits goes unaddressed, premium payments will more than double on average for Marketplace enrollees who currently receive assistance via the ACA’s enhanced premium tax credits. In material terms, affected enrollees will see their premiums increase by an average of $1,016 next year.

However, not all hope is lost. Continued inaction to extend the ACA premium tax credits this week drove momentum in the House. Additional members of Congress signed on to a discharge petition that will force a vote in January on a three-year extension of the ACA premium tax credits. With this window of opportunity, it is imperative that future physicians continue to call their Congress members to demand a three-year extension of these tax credits.

Call both YOUR US Senators and your House Rep at 202-224-3121

Urge them to take quick action in the new year to renew the ACA tax credits.

Yesterday, our US Senators held a vote to extend the ACA premium tax credits for three years. Despite the fact that these tax credits make coverage affordable for millions of Americans, this vote failed to pass.

Four Republican Senators (Sullivan and Murkowski from Alaska, Hawley from Missouri, and Collins from Maine) voted for the bill, along with all Senate Democrats, but that wasn’t enough to reach the 60 votes it needed to pass. (See how your US Senators voted – Click Here)

The Senate also voted on another bill introduced by Republican leaders that did not extend the tax credits but instead created new health savings accounts. We’ll tell you more about what those are soon.

Congress still has time to act, but time is running out.

The ACA tax credits expire on December 31st.

If we can afford trillions in tax breaks for wealthy people and corporations, we can afford premium tax credits that help hard-working Americans and small businesses to keep their insurance.

Without congressional action, millions of Americans face doubling or even tripling of their health insurance premiums because insurance companies are raising 2026 premiums by 30%. This price increase will keep millions from being able to renew their coverage, forcing them to become uninsured. This New Year, let’s NOT start the dismal road back to the days before the Affordable Care Act when about 50 million Americans were uninsured.

Reminder: In the Fight for Health Care Justice HOPE is a Verb!

A 2-minute call can help create a holiday miracle for millions. Congress still has a chance to vote for renewal of the tax credits!

- Call both YOUR US Senators and your House Rep at 202-224-3121 (Call anytime 24/7)

- Urge them to take quick action before year end to renew the ACA tax credits.

Hello:

My name is [First Name] [Last Name]–. I live in [insert town, city]. I would like to leave a message for the Senator/Representative.

I’m studying to be a physician, and I’m very concerned about the looming expiration of the Affordable Care Act enhanced premium tax credits. Failure to renew these tax credits will make premiums unaffordable and cause millions of people to lose health coverage. Our country can do better

As a future physician I also understand abortion care is basic, necessary health care. Limiting access to abortion care should NOT be a requirement for renewal of the ACA tax credits.

Health care is not a luxury. Congress must take quick action before year end to avoid cutting healthcare coverage, it’s a basic human need. I urge Senator/Representative [Name] to vote to renew the ACA premium tax credits.

Thank you for taking my call.

Info to Know & Share

ACA Marketplace Open Enrollment for 2026 Health Plans

- Starts Nov. 1, 2025 – Closes Jan. 15, 2026

People can enroll online, by phone or with help of a free assister

- Online: Visit healthcare.gov OR Para Español: cuidadodesalud.gov

- By Phone: Call the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) The call center is open 24 hours a day, 7 days a week (except on holidays).

- Get Free Help: To schedule a free in-person or virtual meeting with a trained assister visit healthcare.gov/find-local-help then search your city, state, or ZIP code for a list of local people and organizations that can help you apply for coverage

Enrollment Dates & Deadlines

Healthcare.gov Enrollment Information

- November 1: Open Enrollment starts — first day you can enroll in, renew, or change health plans through the Marketplace for the coming year. Coverage can start as soon as January 1.

- December 15: Last day to enroll in or change plans for coverage to start January 1.

- January 1: Coverage starts for those who enroll in or change plans by December 15 and pay their first premium.

- January 15: Open Enrollment ends — last day to enroll in or change Marketplace health plans for the year. After this date, you can enroll in or change plans only if you qualify for a Special Enrollment Period.

- February 1: Coverage starts for those who enroll in or change plans December 16 through January 15 and pay their first premium.

at any time.

Note: Enrollment deadlines are extended to January 31, 2026 in California, Idaho, Massachusetts, New Jersey, New York, Rhode Island, and Washington DC, in Virginia it’s January 30, 2026

Hot Tips & Avoiding Financial Penalities

- Read all notices from the marketplace and your insurer and respond to requests in a timely manner.

- Do not rely on auto-enrollment. If you automatically re-enroll, you may not realize your 2026 premiums have gone up until your first bill arrives in January–at which time you will only have a couple weeks to select a new plan.

- Actively update your information and compare available plans.

- Estimate your income as accurately as possible for the year ahead.

- If your income changes during the year, update your marketplace account as soon as you can—get help from an assister to adjust your premium tax credit amount.

- Stay up to date with premium payments or get help if payments become unaffordable.

- Reconcile your premium tax credits during tax season in 2026.

- Use the Find Local Help tool to locate enrollment assisters near you – visit www.healthcare.gov/find-local-help

Assisters can provide you with free and unbiased help with signing up for marketplace health plans.

We thank Community Catalyst for producing and sharing this resource list

Additional Resources:

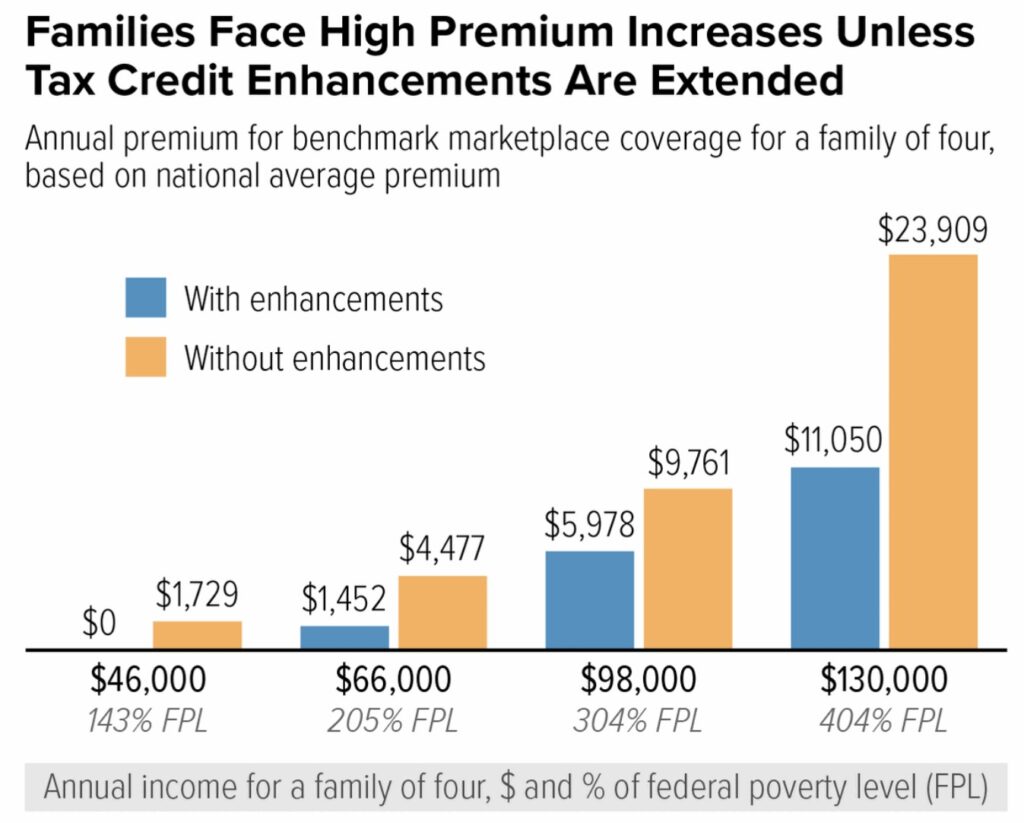

Are Health Insurance Costs about to Double for You? Your Family? Your Friends?

Click Image to Learn More & See National & State-by State Premium Increases if ACA Tax Credits are Allowed to Expire

Source: Health Insurance Premium Spikes Imminent as Tax Credit Enhancements Set to Expire,

Center on Budget & Policy Priorities (CBPP)

Health Insurance Costs Skyrocketing as ACA Premium Tax Credit Renewal Looms, Endangering Health Coverage for Millions

On December 31st, 2025, the Affordable Care Act’s enhanced premium tax credits that make coverage affordable for over 20 million Americans are set to expire. This means premium payments for ACA Marketplace coverage will increase by more than double, on average, by $1,016 a year. New polling from KFF demonstrates that:

1 in 4 ACA Marketplace Enrollees would say they would “very likely” go without insurance,

as the cost of such care becomes wholly unaffordable.

Due to a lack of political will and sense of urgency within Congress to renew the tax credits , needed Congressional action has not been taken as of yet to extend these ACA premium tax credits. This inaction spells deep harm for families across the nation, especially for those living in rural areas, who face an average 107% increase in premium costs. And even more disturbingly, some legislators are attempting to leverage the threat of millions of Americans losing their health care coverage in order to push a nationwide abortion care ban.

The time is now to raise our voices as students who believe strongly that healthcare is a human right to inform our congressmembers of our beliefs, values, and stories. Lawmakers of both parties must hear from their constituents, especially their future physicians, that this is an urgent matter which must be solved now.

What Can YOU Do?

- Call your members of Congress at 202-224-3121 and demand that they stand up to protect access to healthcare, address rising healthcare costs, and extend premium tax credits now. See sample customizable script below.

- Share this info and the resources below with your family, friends, and classmates with encouragement for them to call and make their voices heard in Congress too.

- Find both YOUR U.S. Senators & House Representative HERE

-

- Call anytime 24/7 – Tell them we can afford to prioritize health care over tax breaks for billionaires. Work together to pass a budget that ensures access to health care coverage, extends the ACA premium tax credits, and restores Medicaid funding.

Hello:

My name is [First Name] [Last Name]–. I live in [insert town, city]. I would like to leave a message for the Senator/Representative.

I’m studying to be a physician, and I’m very concerned about the looming expiration of the Affordable Care Act enhanced premium tax credits. Failure to renew these tax credits will make premiums unaffordable and cause millions of people to lose health coverage. Our country can do better

As a future physician I also understand abortion care is basic, necessary health care. Limiting access to abortion care should NOT be a requirement for renewal of the ACA tax credits.

Health care is not a luxury. Congress must take quick action to avoid cutting healthcare coverage, it’s a basic human need. I urge Senator/Representative [Name] to vote to renew the ACA premium tax credits.

Thank you for taking my call.

Are Health Insurance Costs about to Double for You? Your Family? Your Friends?

Click Image to Learn More & See National & State-by State Premium Increases if ACA Tax Credits are Allowed to Expire

Source: Health Insurance Premium Spikes Imminent as Tax Credit Enhancements Set to Expire,

Center on Budget & Policy Priorities (CBPP)

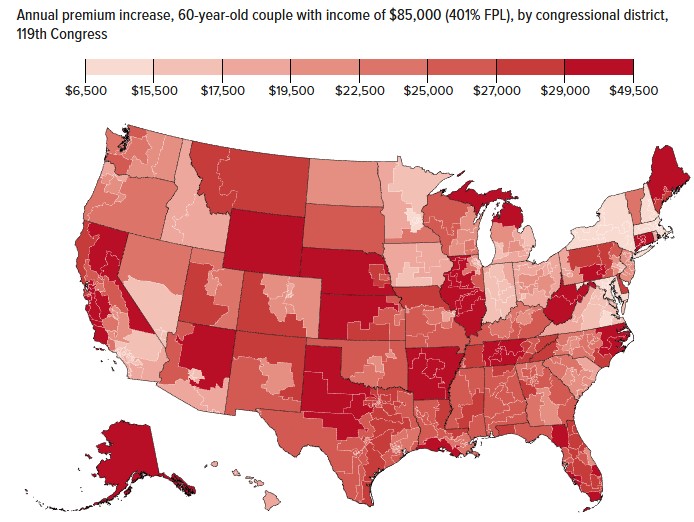

Premium Increases Without Tax Credit Extension by Congressional District

Click Map to Premium Increases by Congressional District

Source: Marketplace Enrollees In Every Congressional District Face Steep Premium Increases Unless Tax Credit Enhancements Are Extended, CBPP

Info to Know & Share

ACA Marketplace Open Enrollment for 2026 Health Plans

- Starts Nov. 1, 2025 – Closes Jan. 15, 2026

People can enroll online, by phone or with help of a free assister

- Online: Visit healthcare.gov OR Para Español: cuidadodesalud.gov

- By Phone: Call the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) The call center is open 24 hours a day, 7 days a week (except on holidays).

- Get Free Help: To schedule a free in-person or virtual meeting with a trained assister visit healthcare.gov/find-local-help then search your city, state, or ZIP code for a list of local people and organizations that can help you apply for coverage

Healthcare.gov Enrollment Information

- November 1: Open Enrollment starts — first day you can enroll in, renew, or change health plans through the Marketplace for the coming year. Coverage can start as soon as January 1.

- December 15: Last day to enroll in or change plans for coverage to start January 1.

- January 1: Coverage starts for those who enroll in or change plans by December 15 and pay their first premium.

- January 15: Open Enrollment ends — last day to enroll in or change Marketplace health plans for the year. After this date, you can enroll in or change plans only if you qualify for a Special Enrollment Period.

- February 1: Coverage starts for those who enroll in or change plans December 16 through January 15 and pay their first premium.

at any time.

Note: Enrollment deadlines are extended to January 31, 2026 in

California, Idaho, Massachusetts, New Jersey, New York, Rhode Island, and Washington DC,

in Virginia it’s January 30, 2026

- Read all notices from the marketplace and your insurer and respond to requests in a timely manner.

- Do not rely on auto-enrollment. If you automatically re-enroll, you may not realize your 2026 premiums have gone up until your first bill arrives in January–at which time you will only have a couple weeks to select a new plan.

- Actively update your information and compare available plans.

- Estimate your income as accurately as possible for the year ahead.

- If your income changes during the year, update your marketplace account as soon as you can—get help from an assister to adjust your premium tax credit amount.

- Stay up to date with premium payments or get help if payments become unaffordable.

- Reconcile your premium tax credits during tax season in 2026.

- Use the Find Local Help tool to locate enrollment assisters near you – visit www.healthcare.gov/find-local-help

Assisters can provide you with free and unbiased help with signing up for marketplace health plans.

We thank Community Catalyst for producing and sharing this resource list

Additional Resources:

As AMSA celebrates its annual National Primary Care Week, we are excited to announce that AMSA has formally endorsed Senator Sanders and Jeff Merkley’s Health Care Workforce Expansion Act, which seeks to address our looming physician shortage.

“This bill is about investing in the future of health care in America,” Sanders said.

“It is about making sure that no matter where you live — whether it’s a big city

or a small town — you can see a doctor, get dental care and

have access to a nurse when you need one.”

AMSA has long been a voice calling for a concerted response to this crisis. We recognize that we are situated within a country with the material means to foster a diverse physician workforce that is poised to meet the healthcare needs of all communities, especially communities historically underserved by our health care system. In order to bring forth this reality for America’s health care system, bipartisan and commonsense solutions to this crisis must be advanced.

Most recent data from the AAMC shows that the nation will face a physician shortage of up to 86,000 physicians by 2036. These shortages are especially pronounced in primary care specialties, with projections estimating a shortage of up to 19,900 primary care physicians.

Senator Sanders’ Health Care Workforce Expansion Act seeks to address the physician shortage crisis by:

- Making nonprofit medical school tuition free for students who commit to practicing primary care for at least 10 years

- Adding more than 50,000 new slots for the Medicare Graduate Medical Education program, dedicating 30% to primary care and 15% to psychiatry residencies

- Expanding the Teaching Health Center Graduate Medical Education Program, adding 15,000 new community-based primary care residency positions; and

- Providing $20,000 relocation grants to doctors, dentists and nurses who agree to practice in rural communities.

Read the bill text here

Read a summary of the bill here

Read News Release: Sanders, Merkley Introduce Legislation to Make Medical, Dental and Nursing Schools Tuition Free and Expand the Health Care Workforce

The legislation is endorsed by a broad coalition of health care and labor organizations, including the American Association of Colleges of Nursing; American Association of Colleges of Osteopathic Medicine; American Academy of Family Physicians; American Association of Teaching Health Centers; American Federation of State, County and Municipal Employees (AFSCME); American Institute of Dental Public Health; American Medical Student Association; American Nurses Association; AFT: Education, Healthcare, Public Services; Association of Clinicians for the Underserved; Committee of Interns and Residents/SEIU Healthcare and the National Rural Health Association.

Due to Congressional inaction to pass a new federal budget which protects affordable healthcare, a government shutdown has been triggered.

AMSA believes that health care is a human right, not a luxury.

As future physicians, we must raise our voices.

The time to speak out is now.

What to Know about Cuts to Health Care

- In July, Congress passed the One Big Beautiful Bill Act (HR 1), threatening the insurance status of 10 million people across the nation in favor of tax breaks for billionaires.

- A government shut down has been triggered by continued inaction to protect access to care. Without the renewal of premium tax credits, an additional 4 million could lose their coverage.

What is the Impact of the Shutdown

While the impact of this government shut down is in flux, what we know right now is that:

- More than 32,000 employees at the Department of Health and Human Services are set to be furloughed

- CDC communications to the public will be interrupted

- Policy development and regulatory work will largely pause

- Grant review meetings will be canceled and new awards will not be issued by the NIH

- Medical care and critical care at the VA will continue

What can you do?

- Call your members of Congress at 202-224-3121 and demand that they stand up to protect access to healthcare, address rising healthcare costs, and extend premium tax credits now

- Find YOUR U.S. Senators & House Representative HERE

- Call anytime 24/7 – Tell them we can afford to prioritize health care over tax breaks for billionaires. Work together to pass a budget that ensures access to health care coverage, extends the ACA premium tax credits, and restores Medicaid funding.

- Sign up for updates and opportunities to share your stories about the dangers of cuts to care with Code Blue